Investing

To get up to speed and learn the basics of sane and mindful investing the best sources are JL Collins, John Bogle, Mr. Money Mustache, and the likes of them.

Notes

If you invest $6000 at the beginning of each year (the equivalent of $500 per month, but placed at the beginning of the year to facilitate calculations), and start at age 55, assuming 4% annualized nominal return, your balance at age 65 will be about $75,000. If you start at age 40, you will end up with about $260,000. And if you start at age 25 your balance at age 65 will be about $593,000.

-

Never try to time the market. Most actively managed funds actually underperform the market and even if you invested at the worst time you will still end up pretty well.

Terms

- Total Expense Ratio (TER) - costs associated with managing and operating an investment fund, calculated as

TER = fund costs / fund assets - Exchange Traded Fund (ETF) - ETF is an investment fund that explicitly tracks an index, commodity, sector, or an asset. Investors can buy and sell ETFs just like normal stocks – which makes them easy to invest in. ETFs usually track basket of commodities and have low expense ratio.

- Index - is a hypothetical portfolio of investment holdings that represents a segment of the financial market. The index value is mostly based on the prices of underlying holdings but can also depend on revenue-weighting, fundamental-weighting, etc. Weighting is used to adjust impact of individual assets on the index value.

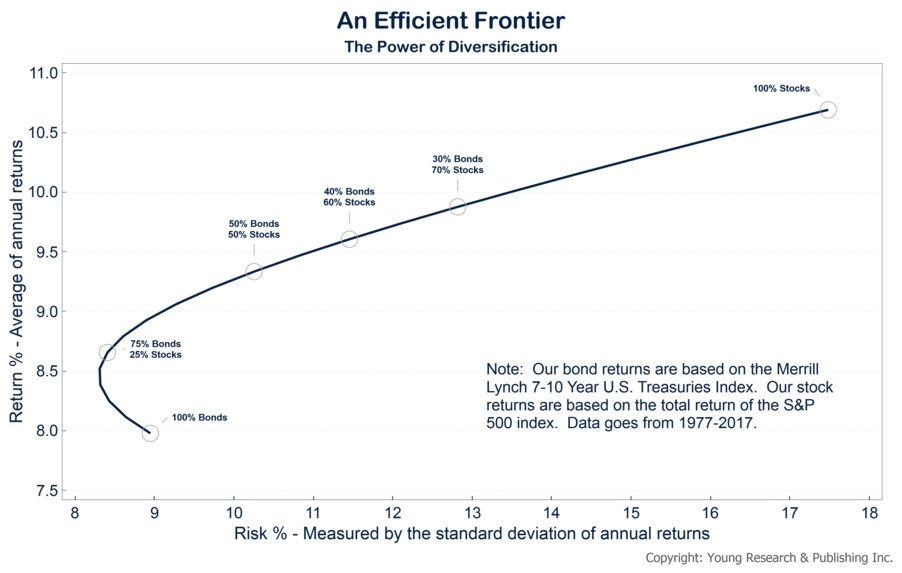

- Efficient Frontier, also here

- Dollar Cost Averaging is an investment strategy that aims to reduce the impact of volatility on large purchases of financial assets such as equities by dividing the total sum to be invested in the market (e.g., $100,000) into equal amounts put into the market at regular intervals (e.g., $2,000 per week over 50 weeks).

Resources

- Stock Series | jlcollinsnh by JL Collins

- The Rate of Return on Everything, 1870–2015

- “Buy and Hold” No More: The Resurgence of Active Trading, (HN)

- A primer on investing for designers and developers

- Ask HN: What to do after $8M (all cash, post tax) exit? | Hacker News

- Bogleheads® investment philosophy

- How People Get Rich Now

- Save Like A Pessimist, Invest Like An Optimist

- John Bogle's 10 Rules of Investing (Reddit)

- Those who are leanfired or working towards it, how do you currently invest? (2021)

- Why not go 100% vanguard target? (2021) - conclusion: it's hard to argue against having 100% in Vanguard

- Things to consider before putting on an options trade (2021)

- Portfolio allocation models

- How Vanguard Index Funds Work

- How To Run An Index Fund: Full Replication Vs. Optimization

- Finance Courses

- Eat The Financial Elephant

- DIY Investing Resource #3: The Intelligent Asset Allocator

- A Non-Expert’s Guide to Early Retirement

- DIY Investing Resource #5: Sound Investing Podcast with Paul Merriman

- The Millionaire Educator

- GoCurryCracker - tax optimization, asset allocation, etc.

- DIY Investing Resource #2: The Little Book of Common Sense Investing #book

- Negative Cash by Tynan

- Variance and Investing by Tynan

- "Any investment other than a risk-free investment or very safe index-fund based portfolio will be higher variance. In order to accept that higher variance you must either have a defensible explanation for why it is higher EV, or you must have a reason why variance will help you. If you don’t, stick to safe investments."

- Openinsider - information on insider trading and cluster buys

- Tikr - free terminal for investment analyzis

- Ten Members Of International Stock Manipulation Ring Charged In Manhattan Federal Court

- Wall Street was the real winner of the GameStop saga

- When Buying the Dip Doesn’t Work: An Analysis of the Dot-com Crash

- Berkshire Hathaway 2021 annual report

- Tech bubbles are bursting all over the place

- Why a small candy company is Warren Buffett’s ‘dream’ investment - steady growth and quality over quantity

- Demystifying financial leverage

- No, You Aren’t Going to Get Rich by Options Trading

- A Wealth of Common Sense - articles about investing for regular people

- Bogleheads.org - HN for investing

- Harry Browne’s 17 Golden Rules of Financial Safety

- Are you trading or gambling?

- you bets (investments) should be sized in percentage, based on Kelly criterion

- Never Hertz to Ask

Places to invest at

- InteractiveBrokers

- Trading212

- InvestEngine - intelligent online investment service

- etfmatic.com - the European roboadvisor

Index Funds

Vanguard vs. iShares

Vanguard has only two accumulative funds (i.e. dividend yield is reinvested) compared to iShares. Accumulative funds are better for tax optimization.